The election of Donald Trump as the new US President has raised questions among our LGF stakeholders regarding the impact on our project. President-elect Trump has indicated that he will lower fuel prices, repeal the Inflation Reduction Act (IRA), retract uncommitted DOE loan guarantee program funds, and challenge California’s climate policies. All of these could potentially negatively impact our ultra-low carbon footprint Sustainable Aviation Fuel project. Therefore, we thought it would be helpful to explain topic by topic why, even though there is some risk of negative impacts, we believe they are largely mitigated and the overall impact is likely minimal.

Presidential Impact on Fuel Prices is Limited. Although much has been said by politicians that they will reduce fuel prices, a recent article in Forbes questions the ability of any President to significantly impact fuel prices for the long term.

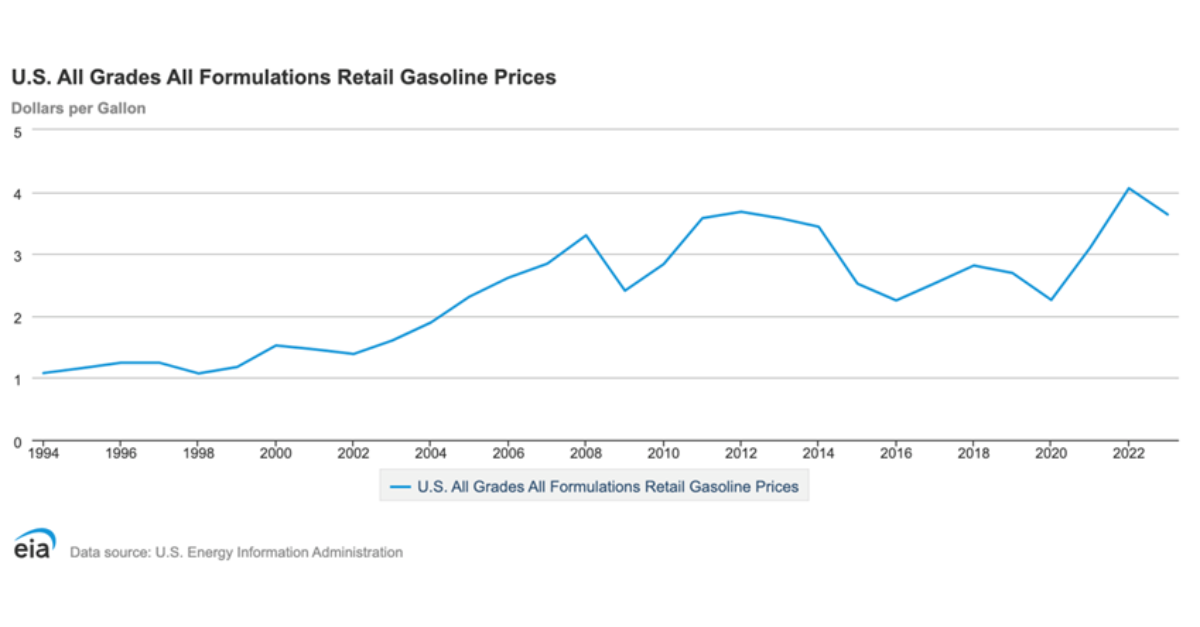

Fuel Price History. As the U.S. Energy Information Administration’s 30-year graph of gasoline prices below indicates, prices dropped from 2014 through 2016 primarily due to the shale oil revolution and fracking prior to the first Trump administration. Prices rose slightly during the Trump administration before dropping significantly in 2020 as a result of COVID when demand plummeted. Coming out of COVID prices rapidly rebounded as people began to travel again and due to decreases in Russian supply following the start of the war in Ukraine in early 2022. Gasoline price is directly correlated to the price of crude oil – which is a worldwide market and in general is minimally impacted by energy policy from any one world leader. This does not mean there is no negative impact from policies related to increased domestic drilling, pipeline construction, federal lease sales, or sales from the Strategic Petroleum Reserve, etc., but other global economic factors of supply and demand tend to outweigh the impact of domestic US politics.

Offsetting value. It would appear obvious that higher fuel prices would be a positive for the LGF project. However, there are two other significant considerations:

Repeal of the Entire IRA is Unlikely. Repeal of the 2022 Inflation Reduction Act (the IRA, which provides for the IRS Section 45Q and 45Z tax credits but is unrelated to the other revenue streams) cannot be done unilaterally by the President, nor by any executive or regulatory agency but rather requires an act of Congress to change the law. There are several reasons why this is unlikely to occur:

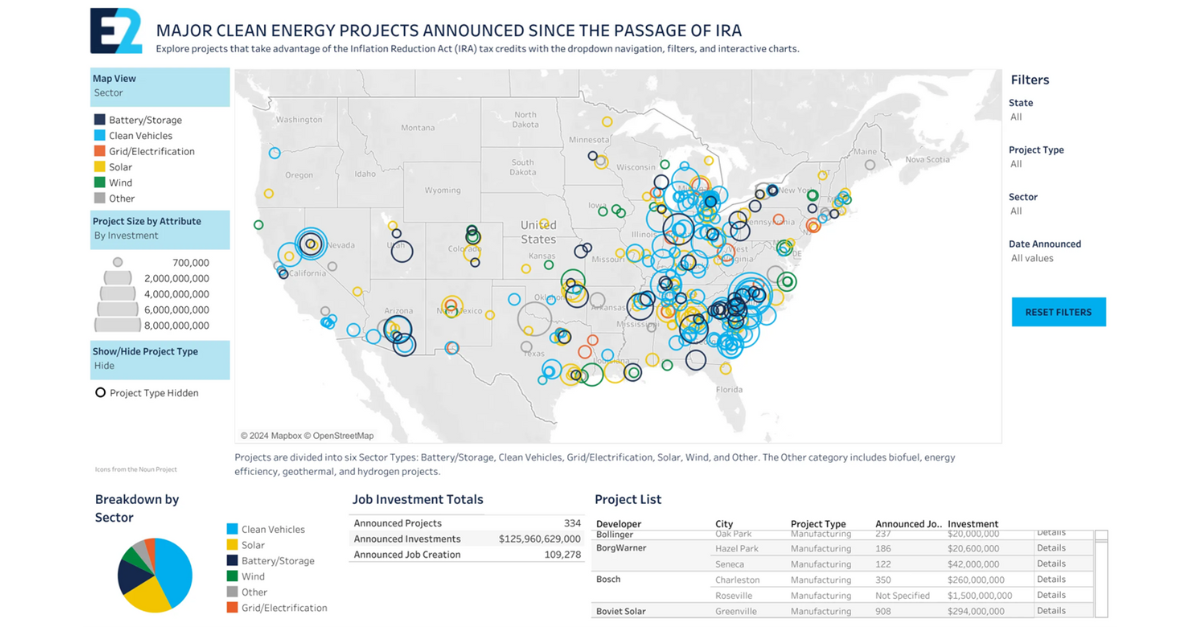

Most IRA funded Jobs and Projects are in Republican areas. A recent article showed that 85% of the estimated $126 billion in private investments and 68% of the 109,300 jobs supported by the IRA are in Republican congressional districts as shown in the figure below from that article. Republican members of Congress are unlikely to support repeal of laws which create so many jobs in their districts. Noteworthy is that our project is in a Republican district, very closely borders the district of the current Speaker of the U.S. House and enjoys the declared support of U.S. Sen. Bill Cassidy (R-LA).

Laws Creating Benefits are Rarely Repealed. In President Trump’s first successful election in 2016, he set repeal of the Affordable Care Act, so called “Obama Care,” as a major platform initiative. Furthermore, most Republicans running for Congress also expressed its repeal as a major goal. However, despite Republican control of the White House, House of Representatives, and the Senate, all attempts to repeal the legislation failed. Given existing Republican support for significant elements of the IRA in both the House and the Senate, and the very limited majorities in each of those chambers, it is reasonable to believe that repeal of the IRA is highly unlikely during the next Trump Administration regardless of the campaign rhetoric.

Repeal of Specific Tax Credits Impacting LGF is Unlikely. As noted above, LGF benefits from two specific Tax Credits in the IRA: the 45Q Sequestration Tax Credit and the 45Z Clean Fuels Production Tax Credit. Not only are there reasons why repeal of the entire IRA is unlikely, there are equally significant reasons why the 45Q and 45Z Tax Credits will not be impacted even if other sections of the IRA are selectively targeted.

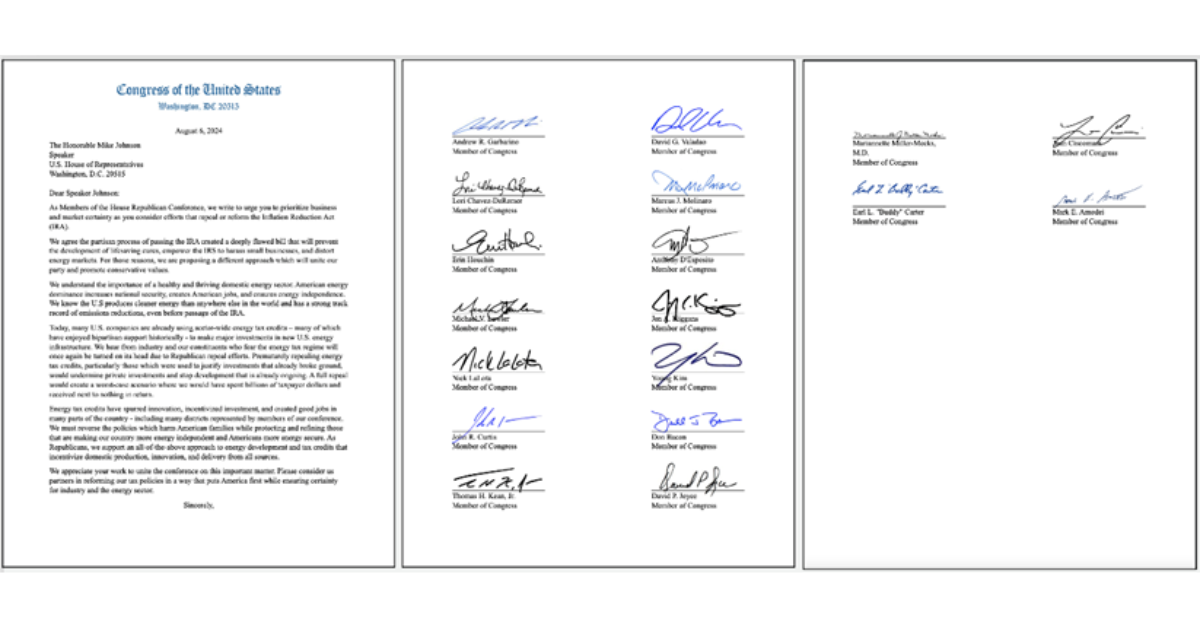

Republican lawmakers are on record opposing repeal of the IRA tax credits. In an August 6, 2024 letter to current Speaker of the House Mike Johnson, eighteen Republican US Representatives stated the following: “Prematurely repealing energy tax credits, particularly those which were used to justify investments that already broke ground, would undermine private investments and stop development that is already ongoing. A full repeal would create a worst-case scenario where we would have spent billions of taxpayer dollars and received next to nothing in return.” Given the relative numbers of Republican and Democrat members of the next House of Representatives, and Republican support, it is extremely unlikely there will be any change to the IRA 45Q and 45Z tax credits.

Bipartisan legislation introduced to extend the 45Z Tax Credit. In October, 2024 a bipartisan group of lawmakers introduced the Farmer First Fuel Incentive Act into both the US House and Senate that proposed extending the IRA-created 45Z Clean Fuel Production tax credit by 10 years (as opposed to any effort to repeal) and furthermore restricting the credit to domestic feedstocks. Not only would this extend a credit that would benefit LGF for production of its Sustainable Aviation Fuel (SAF), but by limiting the eligible feedstocks, it reduces the potential cost of the program and would align with a stated Trump goal to reduce the overall cost of such programs to US taxpayers. Note that it is called “Farmer First” because the initial beneficiaries of the tax credits would be soybean farmers in the Midwest who produce much of the current feedstock going into renewable diesel fuel and the small amount of SAF currently produced domestically.

Previous GOP attempts to repeal the IRA exempted the 45Q Tax Credits. In April, 2023, the House of Representatives passed the Limit, Save, Grow (LSG) Act, which (among many other provisions) targeted certain of the IRA Tax Incentives. Several Republican members of the House joined all the Democrats to ensure the bill made no changes to the 45Q tax credits. The bill was not taken up by the Senate. Given the widening embrace of sequestration by Republicans, the 45Q credits are highly unlikely to change.

Previous Congressional Extension of the 45Q Tax Credits. Unlike the 45Z Clean Fuels Production tax credit which was created in the IRA, the 45Q predates it. The 45Q Sequestration Tax Credit was originally created in 2008 by Congress as part of the Energy Improvement and Extension Act to encourage investment in carbon sequestration. In February 2018 the 45Q sequestration tax credit was extended and enhanced as part of the Bipartisan Budget Act which: raised the amount of the tax credits; introduced a start-of-construction deadline and 12-year claim period; removed the original 75 million metric ton cap; allowed credits for direct air capture and CO2 utilization; and allowed owners of capture equipment to claim credits and transfer the credits to the entity storing the CO2, introducing more flexibility into ownership structures. It is worth noting that this was signed into law by then President Trump.

Administration Supporters Have Vested Interests in IRA Provisions. Many of the significant funders of Trump’s re-election campaign and those expected to be members of his Administration support provisions of the IRA which benefit LGF. Among these are:

North Dakota Governor Doug Burgum. Burgum has been mentioned by many as a strong candidate for Secretary of Energy in the new Trump Administration and had been considered as a potential VP candidate. North Dakota was the first state to receive primacy from the EPA to issue Class VI sequestration well permits, and this occurred while Burgum was its Governor. He is a strong supporter of carbon sequestration.

Howard Lutnick. Lutnick is co-chair of Trump’s transition team and plays a key role in identifying high level appointees for the Trump administration. Lutnick is also the CEO of Cantor Fitzgerald, a major financial services firm with significant investments in companies that benefit from the IRA. Among these are Invenergy, a renewable energy company, and NextEra Energy, the largest US renewable energy developer.

Vicki Hollub. Hollub is CEO of Occidental Petroleum and she raised tens of millions for Trump’s campaign. Occidental currently receives 45Q carbon capture tax credits, has a DOE grant for almost $1 billion for a Direct Air Capture (DAC) hub, and has a stated strategy to market “net-zero” barrels of oil. In May, Hollub said in a statement to Reuters: “I have been talking to policymakers on both sides of the aisle, and will continue to talk to them, to express our support for 45Q, because it will help develop technologies like direct air capture which remove carbon dioxide emissions from the atmosphere and protect America’s energy security.”

Kelcy Warren. Warren is CEO of Energy Transfer and a longtime supporter of Trump. Energy Transfer is a pipeline operator with projects supported by IRA tax credits, including two planned Louisiana CCS hubs, and a hydrogen hub in Texas that recently obtained over $1 billion in DOE funding.

Harold Hamm. Hamm is CEO of Continental Resources and is an energy adviser and political financier for Republican politicians, including Trump. Continental is a major investor in Summit Carbon Solutions, a carbon capture and sequestration (CCS) project that will capture CO2 from ethanol plants and other industrial sources in the Midwest. It relies on the 45Q as its major source of revenue.

The DOE Loan Guarantee Program Probably Will be Affected. Strategic Biofuels believes that the DOE’s Loan Guarantee Program Office (LPO) will almost certainly be impacted to some extent by the change in administration; however, LGF believes that for all the reasons for Republican support stated above and also because of its unique business model and product, any impact on LGF will be substantially mitigated and hopefully avoided altogether. Nevertheless, the impact on LGF is uncertain. Key considerations include:

Redirected focus. Changes are expected because some prospective Trump administration officials have expressed a desire to redirect the deployment of the LPO’s $400 billion pool of loan authority toward fossil fuels and other energy projects favored by Republicans rather than solar, wind, EV’s and other climate related projects.

Reduction or Elimination of LPO funds. The Executive Branch of government cannot retract or revoke the funding authorization that Congress made under the IRA. That would actually require another act of Congress. However, the Executive Branch can delay the expenditures until the authorization for the funds expire which would be Sept 30, 2026. Delays can take many forms including administrative constraints such as tightening requirements or simply delaying steps in the review and underwriting process. As noted above, there are many identifiable strong Trump supporters with vested business interests in the LPO as well as the IRA and it is reasonable to expect a concerted and likely bipartisan effort to extend the expiration date and resist a push by “budget hawks” to reduce or eliminate the funding authorization. That is a political situation that will have to play out.

Strong Republican support for 45Q and 45Z. The strong Republican support for 45Q and 45Z is also present for major job-creating and regional economic impact projects in their districts and should lessen any impact on LGF. A Bloomberg article written in September prior to the election states “LPO, which was signed into law by President George W. Bush, is required to fund innovative energy projects that reduce carbon emissions. But projects related to carbon capture, and other ‘advanced fossil energy technology’ projects are still eligible for billions of dollars in funds. Those projects may see renewed interest if Trump wins as could zero- or lower-carbon energy projects favored by Republicans such as hydrogen and small modular reactors.” We will continue to monitor these developments.

LGF has other financing options. While LGF is in the process of applying for a loan from the Department of Energy Loan Program Office, it is confident about other debt financing options to replace the DOE LPO should its funding capabilities be impacted by the incoming Administration.

LGF Benefits from Strong Louisiana Support. The LGF Project also benefits from strong support across all levels of Louisiana government. These voices can have a significant impact on the national scene:

Louisiana Governor. Current Governor Jeff Landry, an early and outspoken Trump endorser, was previously a vocal opponent of the Biden Administration’s “green agenda” when he was the state’s Attorney General, but has become a strong public supporter of carbon sequestration, recognizing that the State is uniquely positioned to capitalize on its economic promise. He has also expressed his specific support of the LGF project. In part, this is because oil and gas interests view sequestration as a major route to decarbonization of fossil fuels, and these interests play a significant part in the state’s economy. He recognizes the value of the many jobs that will be created in an economically lagging region of the State and earlier this year committed to visit the project site.

US Congressional Delegation. When Strategic Biofuels traveled to Japan in March 2024 and visited several Japanese Ministries and other organizations, we carried letters of support from US Sen. Bill Cassidy and our own 5th District Congresswoman Julia Letlow. Letlow has visited the project site and is in frequent contact with LGF executives. The LGF project is a major economic driver for northeastern Louisiana, not just impacting Representative Letlow’s district, which is the 7th poorest in the country, but also is only a few miles from the neighboring district of current House Speaker Mike Johnson. Furthermore, Sen. Cassidy has been a longstanding supporter of renewable fuels and decarbonization and the creation of jobs that will result from it. Sen. Cassidy has also committed to visit the project site.

Louisiana Legislature. State Rep. Neil Riser and State Sen. Glenn Womack have championed legislation supportive of the LGF project including a bill specific to Caldwell Parish that passed unanimously through both houses of the legislature. That legislation enabled LGF to align the project with the requirements for California’s LCFS Credits. It also enhanced the geologic security of the sequestration reservoir.

Local Government. Strategic Biofuels has obtained unanimous Resolutions of Support for the LGF project from the Caldwell Parish Police Jury (local government) and the School Board. In addition, when applying for its 80% Ad Valorem tax abatement, it obtained unanimous approval from the Police Jury, School Board, and Sheriff, all of them taxing authorities. Local leaders recognize the LGF project for the economic growth it will bring to the Parish. There has been no public opposition.

California’s Low Carbon Fuel Standard is Unlikely to be Affected. President Trump has said that he would stop California’s planned phase out of gasoline powered cars. This has raised some concerns that a Trump administration could negatively impact California’s LCFS and the revenues that LGF may receive from delivering its ultra-carbon negative SAF to that state. However, there is a significant difference between the President’s ability to impact regulation of emissions from automobiles and the new administration’s ability to alter California’s and other states’ carbon trading markets.

Carbon trading markets are secure. Experts say that the carbon trading markets for California and other states are likely safe from new litigation from a second Trump administration.

Tailpipe emissions. Trump has stated that on the first day of his new administration he would cancel California’s ability to outlaw sale of gasoline powered vehicles by 2035.

Conclusions

While some change is inevitable when there is a transfer of power from one political party to the other, we believe that the impact of the election of Donald Trump will have minimal impact on our Louisiana Green Fuels Project. Repeal of the IRA, which established the 45Z Clean Fuel Production tax credit and enhanced the 45Q tax credit, would require an act of Congress. Federal programs, once in place, almost never are repealed regardless of the election rhetoric suggesting the opposite. There are simply too many projects in Republican congressional districts funded by the IRA and there are too many Republicans already on record opposing a complete repeal for the IRA to disappear. In fact, there is bipartisan support for extension of the new 45Z tax credits within the IRA.

It is highly unlikely that there will be any impact on California’s LCFS program as previous attempts failed in Federal Court during the first Trump administration. In fact, states such as New York, Pennsylvania, and others may be spurred to implement their own carbon markets. A Trump challenge to the California Waiver is very possible as the Trump’s 2019 challenge was cancelled when Biden took office. However, the LCFS and the Waiver have been in force for many years now and any effort to upend or revoke them by the federal government would be seen as highly disruptive and detrimental to established markets and economic activity. Even if the Waiver is rescinded, it would have negligible impact on LGF as a producer of SAF.

The most likely impact on the project, that will need to be monitored, would be a result of changes to the DOE loan guarantee program. The Executive Branch cannot change or revoke the allocation of the funds by Congress. However, the requirements can be tightened, and disbursements can be slowed past September 30, 2026, when the Congressional authorization expires. The LPO is so large and relatively entrenched, and enjoys some bipartisan support, that we expect a strong congressional effort to defend and extend the program and minimize the impact of expected proposed budget cuts. We believe the greatest impact would be felt in areas such as wind, solar, and EV’s while limitations on liquid fuel and sequestration projects will be less substantial, if any. As previously stated, we will monitor the political developments closely and position ourselves effectively, enlisting support and intervention from our Congressional delegation and State-based support as needed. In addition, we are pursuing alternative sources of debt and equity financing.

From its inception the Louisiana Green Fuels project was designed with extremely robust economics. The project benefits from the value of the fuel itself, revenues enhanced due to the fuel’s ultra-negative carbon footprints, and revenues directly tied to the tons of carbon sequestered. In all, six different revenue streams support the project, some based on federal law, some based on state law, some based on private markets and some from a combination of those. This great diversity reduces the degree of negative impacts of any one revenue stream as it is compensated for by the inherent strengths in the others. As a result, we remain highly confident in the financial strength and viability of the project regardless of the results of the election and the coming change of administrations. Along with demonstrated support from both Democrats and Republicans, the economic design and impact of the project and its uniquely attractive business model and purpose distinguish it from most others and should enable it to withstand political change without significant impact.

Paul Schubert

CEO, Strategic Biofuels